Introduction

We want to outline all the factors that Canadians face when it comes to money and how they use it. It’s important to know how the system really works in comparison to how we “think” it works. Pay attention to each of the main points below and notice how the majority of them reflect huge profits for the government and banks and very little overall profit for you in comparison. The system is setup to prosper the banks and the government, not you.

Registered Investments

Financial Advisors and the Government encourage you to save money throughout your life and put the money into RRSPs, RRIFs, RESPs etc.

The Reality

When you die, all of the remaining money in your RRSP’s will be taxed at 49.8% (in BC) and given to the government. Are you prepared to give almost half of your life savings to the government instead of your family?

If you are single, widowed or divorced when you die, all of your remaining RRSP’s, RRIF’s, LIF’s etc. will be brought into income and taxed as income in the year you die. If you still have $210,372 or more in your RRSP’s when you pass on, this money will be taxed at 49.8% in BC. This is the tax rate today. Imagine, your life savings will be split with the government. 49.8% for them and 50.2% for you. Hardly seems fair, does it? From my experience, most people never got 49.8% income tax savings when they put the money in.

So, you got a reduction in your income taxes on the seed when you put your money in. The government is going to get their share back at the top tax rate on the harvest.

Is this the inter-generational transfer of wealth people talk about?

Rate of Return

Banks and mutual fund companies give you statements indicating your annual average rate of return. You accept that number as correct.

Average Rate of Return vs Real Rate of Return

The average rate of return is NOT the same as the REAL rate of return that you get. Here is an example.

$7,250 Divided by your initial investment of $100,000 = 0.0725 x 100 = 7.25% for 3 years of investing.

Average Rate of Return

(30% – 25% + 10%)/3 = 5%

Real Rate of Return

7.25%/3 = 2.42%

Your real rate of return is less than your average rate of return, but your statement still says the average. The average is NOT correct.

Deposit Money

What the banks want us to believe: when we get paid, we deposit money at the bank.

Lending To The Bank

We are NOT depositing money at the bank. We are lending the bank money and they are, in turn, lending 10x that amount out to other people.

The banks are using our money to make a profit and paying us almost nothing for it. You might say, “What’s wrong with the banks making a profit?” But, why shouldn’t YOU make that kind of profit with YOUR money?

CPP and OAS

Canada Pension Plan and Old Age Security are supposed to be there for when you retire so that you can live a comfortable life.

The Goal Post Keeps Moving

- The reduction amount has been reducing each year (you get less) – It used to be 30% reduction and now it’s 35% (at age 60)

- If your taxable income is greater than $77,580 then they will start clawing back your old age pension

- The government didn’t even contribute to your CPP, but they control it?

But that’s not all. If you were fortunate to belong to a great pension plan, or saved and invested successfully or did well in real estate or business, you may be a victim of clawback.

If your taxable income is $77,580 or more, you will begin to see your OAS reduced by this clawback. If you earn over $125,696 in taxable income, you will have all of your OAS clawed back. That is your reward for being a good steward of your resources.

CPP

You pay your whole working career into the Canada Pension Plan until you retire and can start to take it out.

You Can’t Take It Out Fast Enough

If you are single, widowed or divorced when you die, and haven’t started to receive your CPP Pension yet, your beneficiaries will receive only $2,500 back from the Canada Pension Plan. That’s it. They don’t care how long you paid into the plan or how much. The government didn’t even contribute to your CPP, but they control it. Personally, from 1970 to 2013, I (Allan) paid in $26,588.79 and my employer paid in $26,588.79. So, I actually have $53,177.58 of my money inside the Canada Pension Plan. My plan is to get it out as soon as I can.

If you are married, your spouse will be entitled to a survivor pension. It’s not the same amount as the full CPP pension of $1,154.58. It’s a little over half as much. $626.63 if you are under age 65 and $692.75 if you are 65 and over.

So, although every T4’d employee is forced to pay into this Government Pension Plan your entire working lifetime, you have no assurance how much you may get back out of it. The government didn’t contribute to your CPP, but they are the one’s in control of it. Why should they be in control of your money?

Go to the Service Canada Website www.servicecanada.gc.ca and register to see your CPP contribution history. Don’t forget to double your contributions to include the amounts that your employers also put in on your behalf.

Mortgage Rates

You get the best rate on a mortgage for your home and feel really good about locking in that rate for 5 years at a time or more.

Mortgage Interest Is WAY More Than You Think

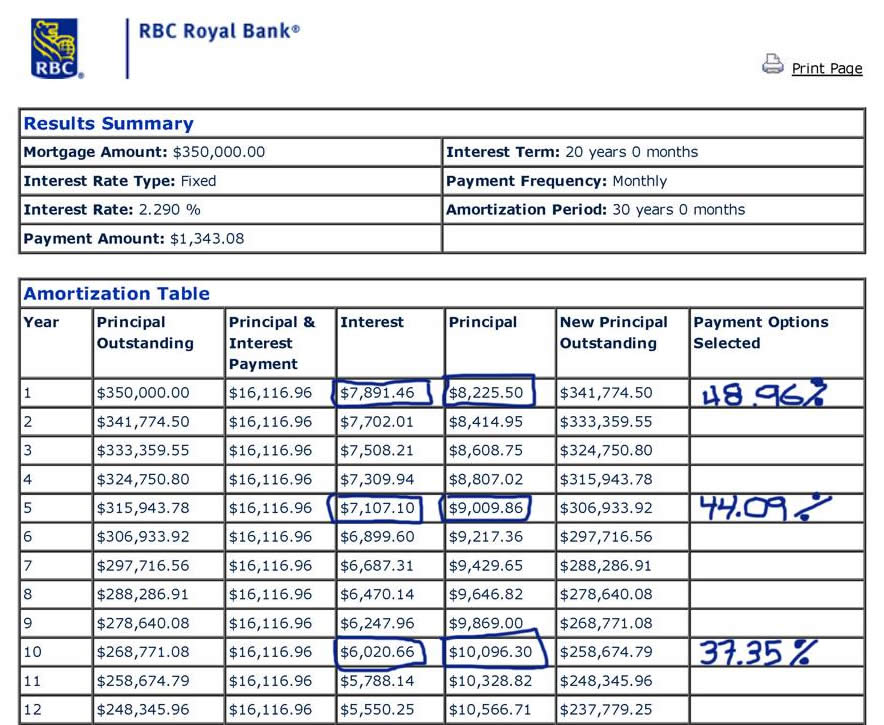

In reality, mortgage interest is “front end loaded” meaning that you pay a lot more interest at the beginning of your mortgage payments than you do at the end. If you look at the actual amortization schedule for your mortgage you will see that you are paying an average of over 40% interest over the first 10 years.

Don’t believe us? Here is a screenshot from the RBC website for a typical home.

Click here to download the full PDF of the Amortization Table See for yourself. You are paying WAY more interest in those first 20 years than the stated 2.290%