I always tell my clients to focus on risk management, not rate of return.

Wealthy people focus on preservation of capital instead of focusing on return on capital. So should you.

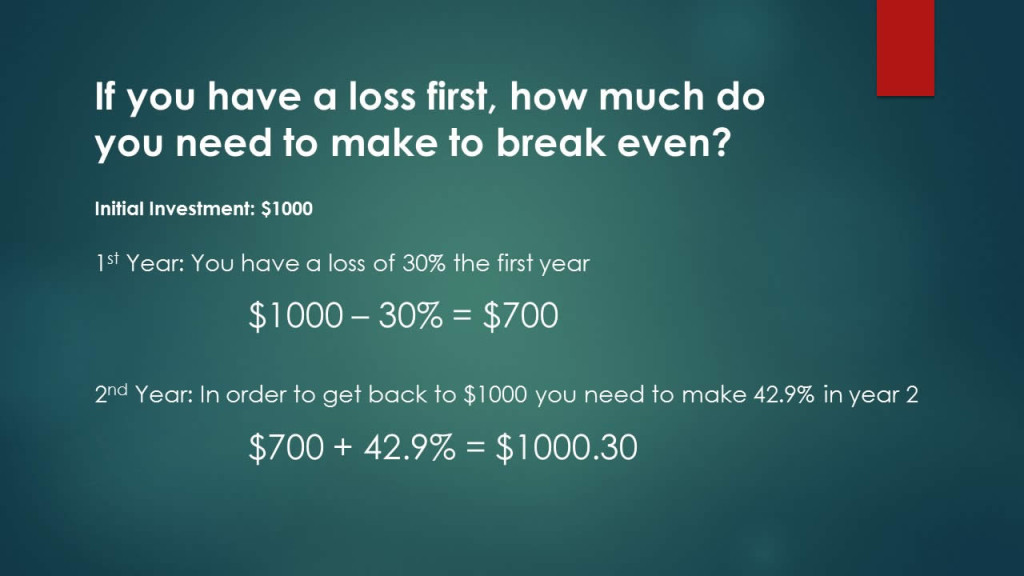

Did you know that if you lose 30% on your investments, you need to earn almost 43% to get back to where you started. What are the chances of that happening quickly? Wouldn’t it be better to not lose the 30% in the first place?

Here is an example:

Turns out, you need to make some pretty significant gains in order to recover from a loss. Here’s a table with the actual numbers.

| Loss | Gains Needed to Recover |

| 10% | 11.1% |

| 15% | 17.6% |

| 20% | 25.0% |

| 25% | 33.3% |

| 30% | 42.9% |

| 35% | 53.8% |

| 40% | 66.7% |

| 45% | 81.8% |

| 50% | 100.0% |

| 55% | 122.2% |

| 60% | 150.0% |

| 65% | 185.7% |

| 70% | 233.3% |

| 75% | 300.0% |

| 80% | 400.0% |

| 85% | 566.7% |

| 90% | 900.0% |