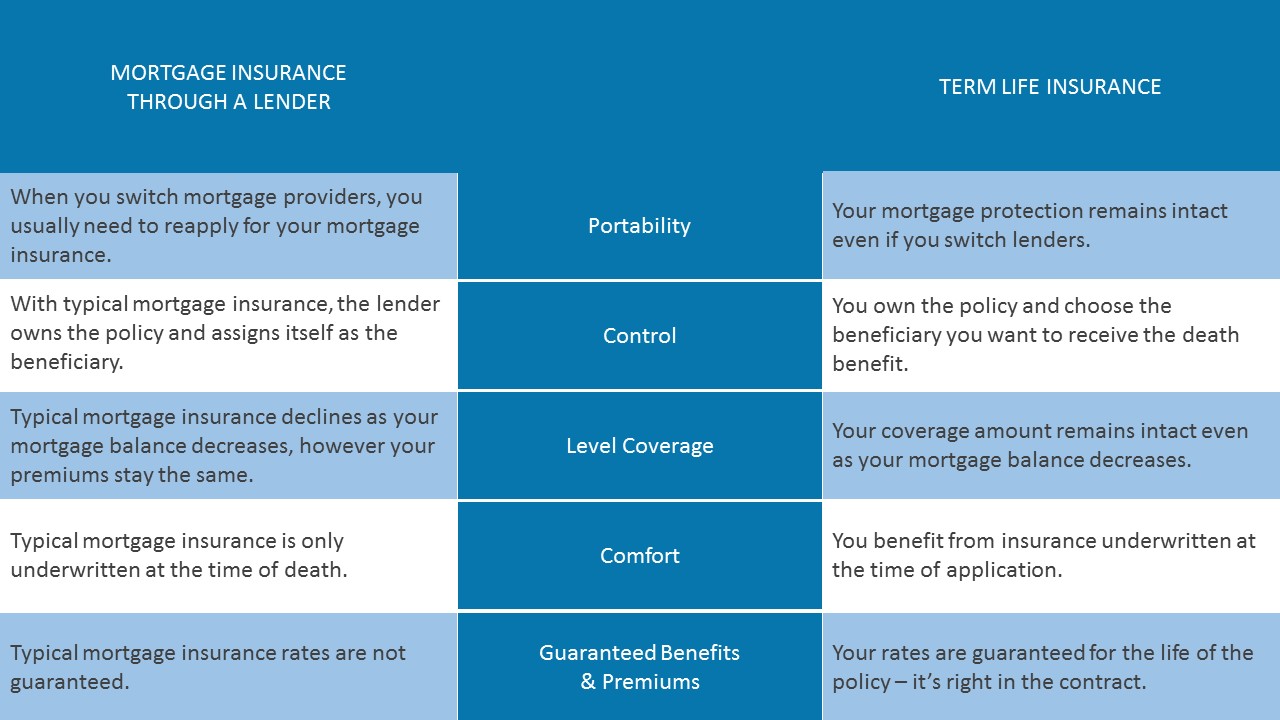

Term Life Insurance vs Mortgage Insurance Through A Lender

Seems like there is hardly a fair comparison. You get the same end result, but Term Insurance makes a whole lot more sense.

See Why Traditional Life Insurance is a Superior Choice

| Bank Mortgage Insurance | Traditional Life Insurance |

| Declining coverage amount based on mortgage balance | Coverage amount stays the same for the duration of the term |

| No discounts on premiums for healthy people | Discounts on your premium if you are healthy |

| The older you are the higher the premiums | Get the best rates based on your own health |

| Pooled policy – No control | You are in complete control |

| Policy is owned by bank | Policy is owned by you |

| Non transferable | Fully transferable |

| Premiums not guaranteed | Premiums fully guaranteed |

| Void if mortgage in default | Insured even if mortgage is in default |

| Lapses if property is sold | Your insurance is portable |

| Not guaranteed at renewal | Automatically renewable to age 75 |

| Most bank plans expire at age 70 or earlier | Fully convertible to permanent coverage |

What you should do

One of the possible solutions we recommend is that you purchase Individual Term Life Coverage for your mortgage in the event of premature death.

The advantages to Individual Term Life are:

- Premium remains consistent for the term of your policy.

- Coverage will never decline even as you pay down your mortgage.

- In the event of premature death, your beneficiaries can either pay off part of (or all of) the mortgage right away, pay off other debts, use the money to fund a child or spouses education, or even invest the money – it’s their choice!

- You can keep the coverage even after you pay off your mortgage.

- Only you can cancel the policy – not the institution that holds your insurance.

- The insurance company does a full underwriting before the policy is issued.

- If policies are purchased on each person’s life and one spouse dies prematurely, the other spouse is still insured.

Your insurance needs are as unique as you are, so it’s important for you to get professional advice to suit those needs. Call us for a review of your unique needs.